Asia-Pacific (APAC) dominated the US$4.5 trillion global net profit pool with a share of 38.2% in 2018, according to a new study by GlobalData, a leading data and analytics company.

The study, based on a sample size of more than 41,000 global public companies across a number of GlobalData core sectors, reviewed the sectorial and geographical net profitability levels in 2018 vs. 2014.

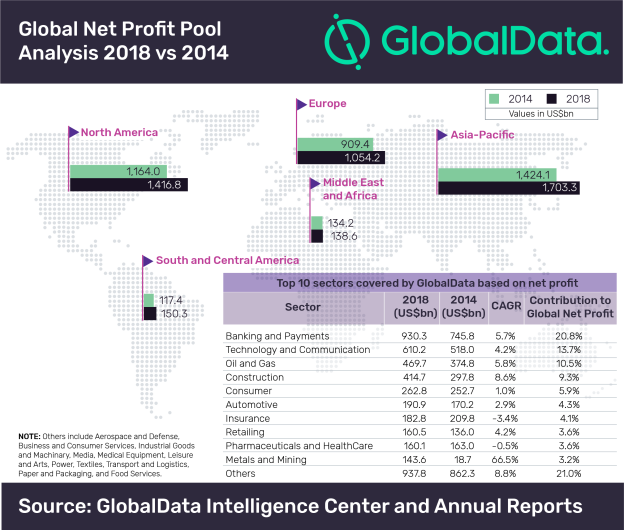

The top 10 sectors covered by GlobalData accounted for about 79% of the global net profit pool, led by banking and payments (20.8%), technology and communication (13.7%), oil and gas (10.5%), construction (9.3%), consumer (5.9%), automotive (4.3%), insurance (4.1%), retailing (3.6%), pharmaceuticals and healthcare (3.6%), and metals and mining (3.2%).

Parth Vala, Company Profiles Analyst at GlobalData, comments: “Majority of the top 10 sectors registered compound annual growth rates (CAGR) over the past five years. However, the growth was rather subdued except for metals and mining, which reported a CAGR of 66.5% during the period.

“Consistent uptick in commodity prices along with increased production capacities to meet the growing demand, and continuous cost saving measures that led to improved cash flows from operations were the major growth drivers.”

On the other hand, the aggregate net profitability of companies in insurance sector declined 3.4% compounded annually as there was a drop in net profit levels from European, North American, and South and Central American insurers in 2018, as compared to that in 2014.

APAC held a share of 38.2%, followed by North America (31.7%), Europe (23.6%), South and Central America (3.4%), and the Middle East and Africa (3.1%) in 2018.

APAC was home to 55.2% of the companies in the sample size, followed by Europe (18.2%), North America (17.8%), the Middle East and Africa (5.9%), and South and Central America (2.9%).

The top 10 sectors accounted for 87.1% of the total net profit of the Middle East and Africa, followed by APAC (81.8%), South and Central America (80.3%), Europe (78.2%), and North America (75.2%).

In terms of CAGR in net profit over the past five years, South and Central America grew by 6.4%, followed by North America (5%), APAC (4.6%), Europe (3.8%) and the Middle East and Africa (0.8%).

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.