According to persons with firsthand knowledge of the plans, Bill Ackman’s Pershing Square is seeking to raise $25 billion for a new closed-end fund aimed at US retail investors. This would more than treble the fee-paying assets that the business currently manages.

According to people who asked not to be named because the target has not been made public, the vehicle, known as Pershing Square USA Ltd., has filed plans to list on the New York Stock Exchange and will significantly increase the management company’s revenue ahead of a potential IPO. According to documents, Pershing intends to impose no incentive fee and a 2% management fee for the US closed-end fund, which would be waived for the first 12 months.

In a share sale that was made public on Monday, Pershing Square secured a $10.5 billion valuation thanks to the anticipated expansion in assets. Among other vehicles, the company already owns a European closed-end fund, Pershing Square Holdings Ltd., with assets of roughly $15 billion.

Investors in the Pershing Management Company are taking a risk on the dependability of the company’s fee-related earnings, while also being protected from incentive fees, or carry. With a market valuation of roughly $42.4 billion, alternative asset manager Ares Management Corp.—which is already publicly traded—represents a ratio of 35.3 times its fee-related earnings for the year ending March 31.

According to the persons, Ackman’s company also intends to raise money for an asymmetric fund that splits its assets between Treasury bonds and possibly high-yield investments. For this approach, Pershing told investors that it hopes to raise at least $5 billion in customer assets.

A representative for Pershing Square declined to respond.

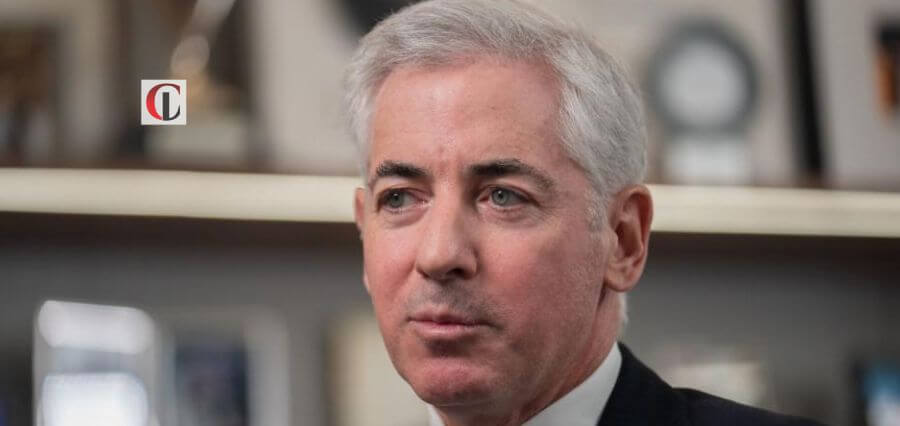

As an activist investor, Ackman gained notoriety by placing bets on firms like Herbalife Ltd. and bond insurer MBIA Inc. In recent months, he has become more visible on social media, actively supported Israel, and campaigned against antisemitism on US college campuses.

As the markets rebounded last year, his firm’s more measured strategy of acquiring sizable stakes in specific businesses, such as Alphabet Inc., Chipotle Mexican Grill Inc., and Hilton Worldwide Holdings Inc., produced a 26.7% gain.

For More Details: https://ciolook.com/