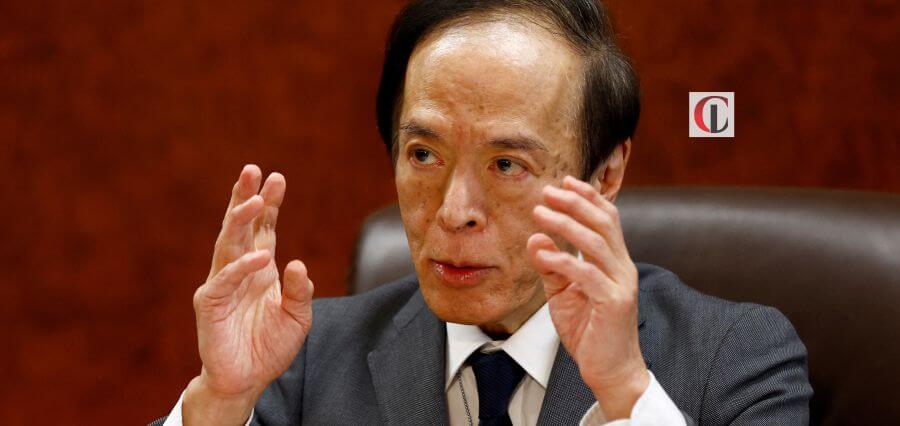

Governor Kazuo Ueda of the Bank of Japan announced that, one year into his position, he had succeeded in transforming the bank’s intricate monetary stimulus program into a more straightforward structure. During his Monday speech in parliament, he added that the BOJ would keep up these initiatives and adjust monetary policy in response to shifts in the economy.

“When I assumed my post a year ago, I felt the BOJ’s policy framework had become a technically difficult one due to various reasons. If economic conditions allowed, I had hoped to make the framework simpler and easier to understand,” Ueda said.

“Thankfully, the economy was in fairly good shape in the previous fiscal year (that ended March 31), so I was able to fulfil my mission,” he told parliament.

Ueda started rolling back his predecessor’s enormous stimulus program as soon as he took office as governor of the BOJ on April 9 of last year. He did this by eliminating the bank’s contentious bond yield control and dovish forward guidance by the end of 2023.

Removing other traces of its unconventional policy, including eight years of zero interest rates, the BOJ marked a historic turn away from its goal of reviving economy through decades of huge monetary stimulus in March. Currently, the BOJ has targets for both short- and long-term interest rates; under yield curve control, however, it only sets one short-term interest rate target, with a range of 0-0.1%.

Although it still acquires government bonds valued at about 6 trillion yen ($39.5 billion) each month, Ueda has stated that the BOJ intends to cut back on purchases in the future. “I would give the governor a grade of 80 on a scale of 100,” said Mari Iwashita, a veteran BOJ watcher who is chief market economist at Daiwa Securities. “While it took a year, Ueda gathered enough data to review the BOJ’s massive stimulus and made progress towards normalising monetary policy.”

The next task for Ueda will be to handle additional interest rate increases with grace and without alarming market participants, many of whom are used to decades of almost free borrowing.

It could be difficult to communicate. The BOJ’s task under former Governor Haruhiko Kuroda was to keep up enormous stimulus until the 2% inflation objective was within reach. Analysts say that because Ueda has adopted a more “data-dependent” stance, his remarks will be closely watched for any minute deviation in his evaluation of prices and the economy.

“The BOJ’s monetary policy is finally ‘back to normal,’ as Governor Ueda has been saying,” according to a source familiar with its thinking. Rate hike decisions will be made gradually and after a close examination of the economy.

It appears that the governor is focused on the upcoming mission. The possibility of another rate hike this year was hinted at by Ueda, who stated last week that inflation will probably pick up speed from “summer towards autumn” as a result of massive salary increases driving up costs.

Reducing its enormous balance sheet—which, at around 733 trillion yen, much exceeds the size of Japan‘s economy—would be another major task for the BOJ. If tapering is done too quickly, bond yields may suddenly rise, raising the cost of repaying Japan’s massive debt.

“By maintaining the pace of bond buying, the BOJ was able to avert a spike in long-term yields. But by stressing its resolve to maintain accommodative monetary conditions, the bank helped accelerate the yen’s declines,” Daiwa’s Iwashita said. “The BOJ is falling into a dilemma”, she said.

Anticipations regarding the sustained decline in Japanese interest rates have exacerbated an undesirable decline in the value of the yen, which is negatively impacting households and retailers by raising the cost of imports. $1 is equivalent to 151.7800 yen.

For More Details: https://ciolook.com/